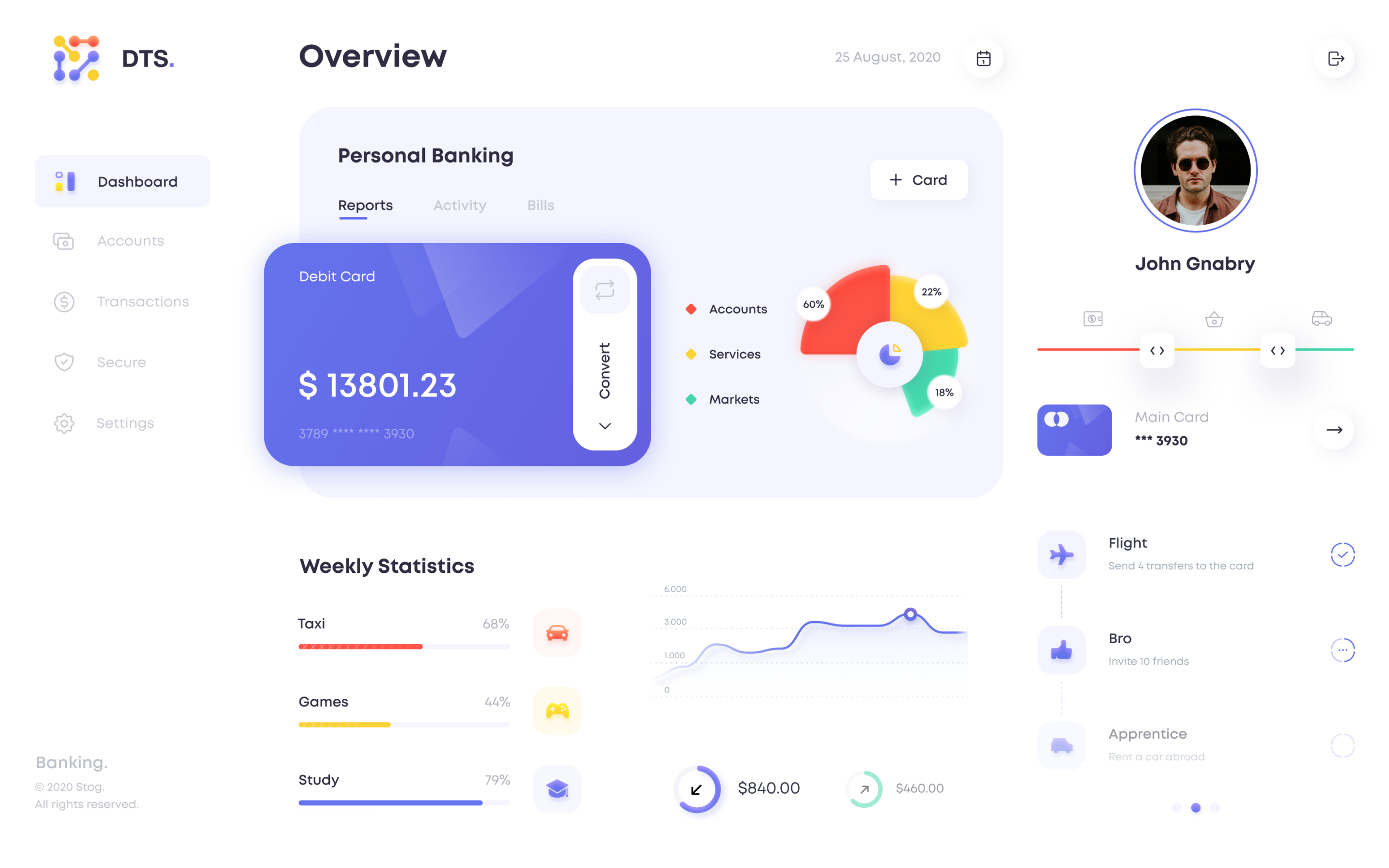

Personal Banking

Personal banking encompasses a variety of financial services designed to meet the needs of individual customers.

Savings Accounts

These accounts allow customers to save money while earning interest. They are ideal for setting aside funds for future needs.

Checking Accounts

These accounts are used for daily transactions, such as paying bills and making purchases. They often come with features like check-writing and debit cards.

Fixed Deposits

These are time-bound deposits that offer higher interest rates compared to regular savings accounts. The funds are locked in for a specific period.

Personal Loans

Unsecured loans that can be used for various purposes, such as home renovations, medical expenses, or vacations.

Home Loans

Mortgages provided to help customers purchase or refinance homes.

Investment Services

Investment products that pool money from many investors to purchase securities.

Mobile and Online Banking

Customers can check balances, view transaction history, and manage accounts through mobile apps and online platforms.

Pay bills directly from the app or online portal.

Deposit checks by taking a photo with a smartphone.

Customer Support

Personalized help from bank representatives.

- In-Branch Assistance

- Call Centers

- Online Chat Support

More

Personal banking services are designed to provide convenience, security, and financial growth opportunities for individual customers. Whether you’re saving for the future, managing daily expenses, or investing for long-term goals, personal banking offers the tools and support you need.

Need help? Send us email now.

Already have an account? Sign Up